Introduction to Institute of Chartered Accountants of Pakistan (ICAP)

ICAP is a prestigious regulating body that promotes, develops and supports over 10,000 Chartered Accountants. We provide qualifications, professional growth and development, share our knowledge, insight and technical expertise, and protect the worth and integrity of the accountancy profession.

The Institute of Chartered Accountants of Pakistan (ICAP) was established on July 1, 1961 to regulate the profession of accountancy in the country. It is a statutory autonomous body established under the Chartered Accountants Ordinance 1961.

ICAP is a globally-recognized professional accountancy body, bringing value to its members, the profession and the wider community. Though ICAP, as compared to other accountancy bodies, is a small in membership size, but on global forums it has very prominent place.

ICAP is a member of International Federation of Accountants (IFAC), International Accounting Standards Board (IASB), Confederation of a Asian & Pacific Accountants (CAPA) and South Asian Federation of Accountants (SAFA).

Useful link: https://www.icap.org.pk/about-icap/

Eligibility Criteria

Eligibility Criteria

You are eligible to join this course if:

- You have cleared HSSC with minimum 50% marks or ‘A’ Level with minimum two passes, or you possess an equivalent qualification or are a graduates with minimum 45% marks.

- Candidates who meet the above criteria can enter the first level (AFC) after registration.

ICAP allows provisional registrations to result awaiting students.

Useful link: https://www.icap.org.pk/do-ca/entry-routes/

CA Qualification

CA Qualification

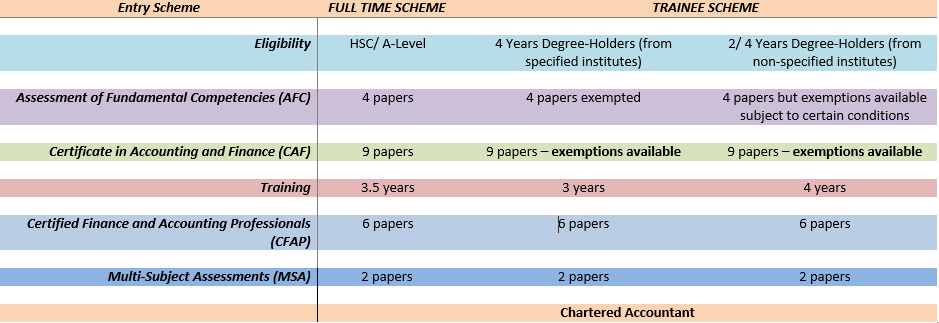

In order to become a qualified chartered accountant and use the designatory letters “CA” after your name you need to complete:

- 4 papers of the Assessment of Fundamental Competencies (AFC) level [unless you are eligible for exemptions for these papers]

- 9 papers of Certificate in Accounting and Finance (CAF)level [unless you are eligible for exemptions for these papers]

- 6 papers of Certified Finance and Accounting Professional (CFAP) level

- 2 papers under Multi Subject Assessments (MSA)

- Presentation and Communication Skills Course (unless exempted)

- 3 to 4 years of relevant practical training [duration depends upon your entry route]

Useful Links:

Full-time scheme: https://www.icap.org.pk/do-ca/entry-routes/full-time-scheme/

Trainee scheme: https://www.icap.org.pk/do-ca/entry-routes/trainee-scheme/

Additional Points:

Additional Points:

- Assessment of Fundamental Competencies (4 papers) are computer-based exams and can be attempted in March, June, September or December each year. The maximum number of attempts per paper in this level is 3.

- Certificate in Accounting and Finance (9 papers) can be attempted in March or September each year. The maximum number of attempts per paper in this level is 6.

- Certified Finance and Accounting Professional (6 papers) can be attempted twice a year in June and December. The maximum number of attempts per paper in this level is 6.

- Multi-Subject Assessments (2 papers) can be attempted twice a year in June and December. There is no limit to the number of attempts for this level.

- PCSC – Presentation and Communication Skills Courses 1 & 2 have been made mandatory by ICAP for CA candidates, with effect from May 5, 2015 and these courses can only be delivered by an Approved PCSC Provider. Useful links: https://www.icap.org.pk/guidance-on-pcsc/ & https://skans.edu.pk/courses/ca/pcsc.php

- The training period can range from 3 to 4 years depending upon the entry route of the candidate. Useful link: https://www.icap.org.pk/students/training/

Exemptions from CA exams

Exemptions from CA exams

You may be eligible for exemptions from some of the CA exams, based on your previous academic/ professional qualifications.

The exemptions on the basis of academic qualification are available to the following categories:

- Four years degree from Specified Degree Awarding Institute (SDAI)

- Four years degree from universities other than SDAI

- Two years degree from any universities

- HSSC or Equivalents

- A Levels

In order to identify if you can claim exemptions or how to claim them, please use the following link:

https://www.icap.org.pk/do-ca/registration-and-exemptions/

Fees payable to ICAP

Fees payable to ICAP

There are 3 categories of fees payable to ICAP:

- Registration or Transfer fees: Payable when you initially register with ICAP

- Annual Subscription: An annual amount that becomes payable to maintain your registration with ICAP

- Exam Fees/ Exemption fees: This amount is payable when you plan on sitting for an exam in a particular attempt. A fee is also payable if you are claiming exemptions.

Information on the exact fees payable, is available on this link: https://www.icap.org.pk/students/fees-and-forms/fees/

Tuition Support for CA:

Tuition Support for CA:

SKANS ECampus is currently offering on-line tuition support for just the Certificate in Accounting And Finance level but we ensure you get quality tuition support throughout your CA journey.

If you are planning to study CA with SKANS ECampus, you need to first register on-line on this website (no charges incurred). You can then enroll for a particular course and exam attempt.

For further information on the Tuition support available from SKANS ECampus, contact us via the contact tab on the website or drop us an e-mail at info@skansecampus.com

If you have to start at the AFC level, then the following link will provide you with more detailed information: https://skans.edu.pk/courses/ca/ca.php

Getting started with ICAP:

Getting started with ICAP:

If you have decided to start your CA journey, then the following link provides complete information on the steps you need to take to register with ICAP: https://www.icap.org.pk/do-ca/